Houzz Renovation Barometer Badge

As a home remodeling professional and member of the Houzz Industry Panel, Stebnitz Builders has provided input on business conditions in the July 2016 Q2 release. Stebnitz received the Houzz Industry Research - Barometer Badge on July 28, 2016.

Houzz Industry Research - Renovation Barometer

Houzz Renovation Barometer tracks confidence in the home renovation market among industry professionals. More than 5,000 U.S. residential service providers are members of the Houzz Industry Panel and provide quarterly updates on the health of the industry. To learn more about the findings from the Q2 2016 Barometer research visit info.houzz.com/houzzBarometer.html

The Houzz Renovation Barometer, which tracks industry optimism in quarter-over-quarter and year-over-year market improvements, posted high Q2 readings across all industry groups (63-78 out of 100), reflecting widespread industry confidence in quarter-over-quarter market gains. The outlook for Q3 continues to point toward positive growth in all sectors.

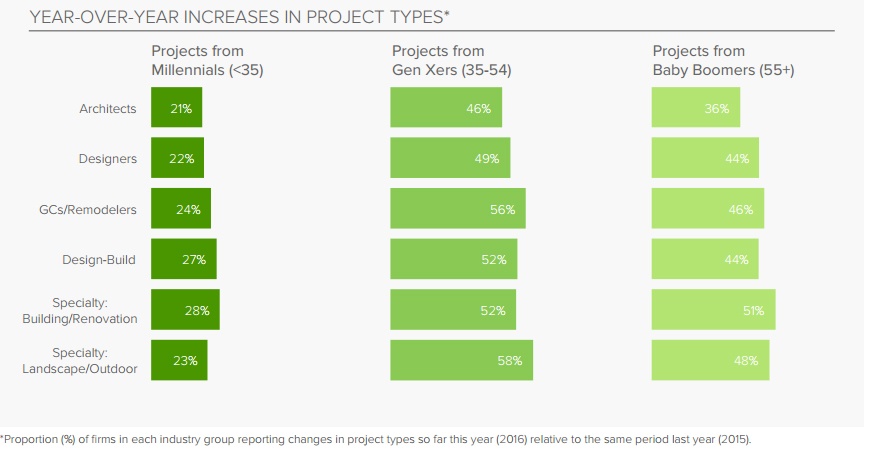

Uptick in Gen Xer Activity

Half or more firms across all industry sectors report an increase in projects from Gen Xers (ages 35-54) so far this year, relative to the same period last year (46%-58%). Projects from Baby Boomers (55+) also increased for more than one-third of firms across all sectors (36%-51%). Not surprisingly, significantly fewer firms (21%-28%) experienced an uptick in projects from Millennials (<35).

Year-over-year increases in business activity across all sectors tend to be driven by older homeowners. Half or more firms across all sectors report an increase in activity of homeowners ages 35-54 so far in 2016, relative to the same period in 2015 (46-58 percent). Projects from Baby Boomers have increased for many as well (36-51 percent). Unsurprisingly, projects from Millennials are increasing at a slower rate, with 21-28 percent of firms across all sectors reporting growth in projects from this age group.

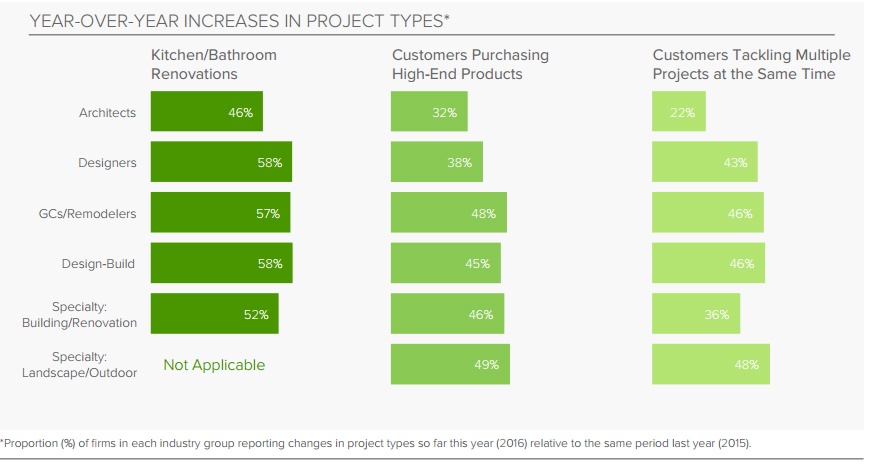

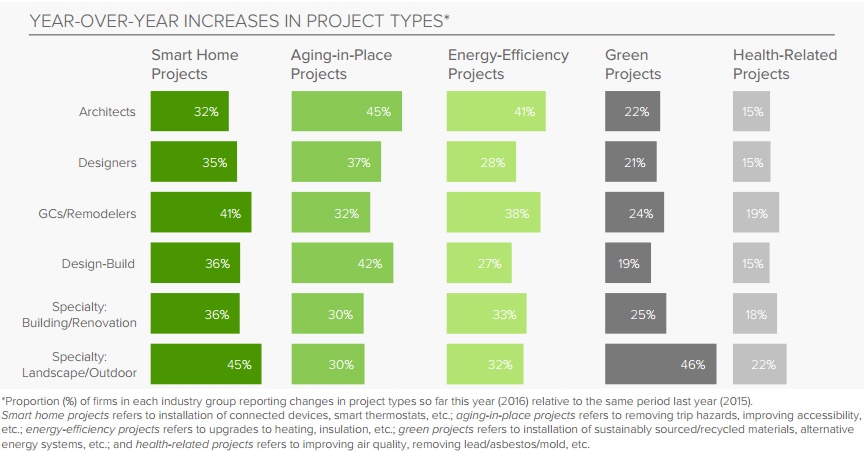

Looking at other factors driving increased business activity, a third or more firms across all sectors report that more clients are purchasing high-end products in 2016 relative to the same time in 2015 (32-49 percent), and a quarter or more of firms are seeing more clients are tackling multiple projects at the same time (22-48 percent). In addition, half or more firms report an increase in year-over-year kitchen and bathroom renovations (46-58 percent). A third or more firms across all industry sectors report increases in smart home technology installations and aging-related upgrades (32-45 percent and 30-45 percent, respectively). Many firms also experienced growth in energy efficiency upgrades and eco-friendly/green projects (27-41 percent and 19-46 percent, respectively).

Q2 2016 Houzz Renovation Barometer Finds Renovating Homeowners Purchasing More High End Products and More Likely to Take on Multiple Projects in 2016.

Widespread Industry Confidence Continues; Number of Projects from Gen Xers on the Rise Houzz Study Finds - Read full article here posted on July 20, 2016 via Houzz.com

Kitchen and Bathroom Projects on the Rise

The nature of renovations in the first half of 2016 changed relative to the same period in 2015. Half or more firms across all industry sectors report a rise in kitchen and/or bathroom renovations (46%-58%). A third or more firms experienced an increase in homeowners purchasing high-end products (32%-49%) and/or more homeowners tackling multiple projects at the same time (22%-48%). The increases in these project types are smaller for architects than for other sectors.

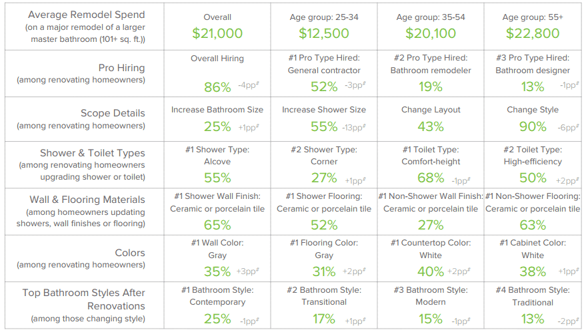

Homeowners are investing larger budgets into their kitchen and bathroom renovation projects, according to the fifth annual Houzz & Home survey of more than 120,000 respondents in the U.S. The average spend on kitchen and master bath remodeling projects in 2015 increased by 12 percent year over year. Consistent with the last five years, kitchens remain the most popular interior remodeling project (31 percent), followed by master/non-master bathrooms (22 and 26 percent, respectively) and living/family rooms (23 percent). Renovating homeowners also tackled a more diverse set of projects in 2015 than in 2014, with a greater emphasis on upgrades to interior spaces (72 percent versus 69 percent) and exterior features like windows and roofing (56 percent versus 53 percent).

When it comes to the motivations behind renovations, finally having the time was the top trigger for home renovation projects in 2015 (38 percent), ahead of finally having the financial means (37 percent), the top trigger for 2014 projects. Homeowners are renovating instead of buying a “perfect” home largely due to their desire to stay in their current home or lot (49 percent) or remain in their current neighborhood (31 percent). Financial considerations such as renovation being a more affordable option or providing a better return on investment (28 percent each) trail behind.

Spending is on the Rise for Kitchen and Bath Renovations, Houzz Survey Finds

Over a quarter of renovation projects are driven by recent home purchases - Read full article here posted on June 22, 2016 via Houzz.com

More Smart Home and Aging-Related Upgrades

For many firms, the first half of 2016 also brought more specialized projects relative to the same period last year. A third or more of firms across all industry sectors report increases in smart home technology installations and aging-related upgrades (32%-45% and 30%-45%, respectively). Many firms also experienced growth in energy-efficiency upgrades and eco-friendly/ green projects (27%-41% and 19%-46%, respectively).

Download the current quarterly report to learn about the current state of professional confidence in the quarter-over-quarter and year-over-year improvements in the home renovation market on national, state and metro levels:

- Read the press release

- Download the national report

- Download state-level tables

- Download the metro-level tables

- Download state-level tables for comparison to pre-recession levels

- Download the metro-level tables for comparison to pre-recession levels